The business inventory offset account plays a pivotal role in the financial management of organizations, providing a comprehensive understanding of its purpose and usage. This guide delves into the intricacies of this accounting concept, examining its advantages, disadvantages, and practical applications.

As a key element in inventory management, the business inventory offset account offers a unique perspective on inventory valuation and its impact on financial statements. Its effective implementation can lead to optimized inventory levels, improved cash flow, and enhanced financial performance.

Definition of Business Inventory Offset Account

A business inventory offset account is a contra-asset account that reduces the value of inventory on the balance sheet. This account is used to track the estimated amount of inventory that is unsaleable or obsolete.

Unlike a traditional inventory account, which reflects the total value of all inventory on hand, the inventory offset account only reflects the estimated value of unsaleable or obsolete inventory. This allows businesses to more accurately represent the value of their inventory on the balance sheet.

Businesses that commonly use this type of account

Businesses that commonly use inventory offset accounts include:

- Retailers

- Manufacturers

- Wholesalers

Accounting Treatment of Inventory Offsets

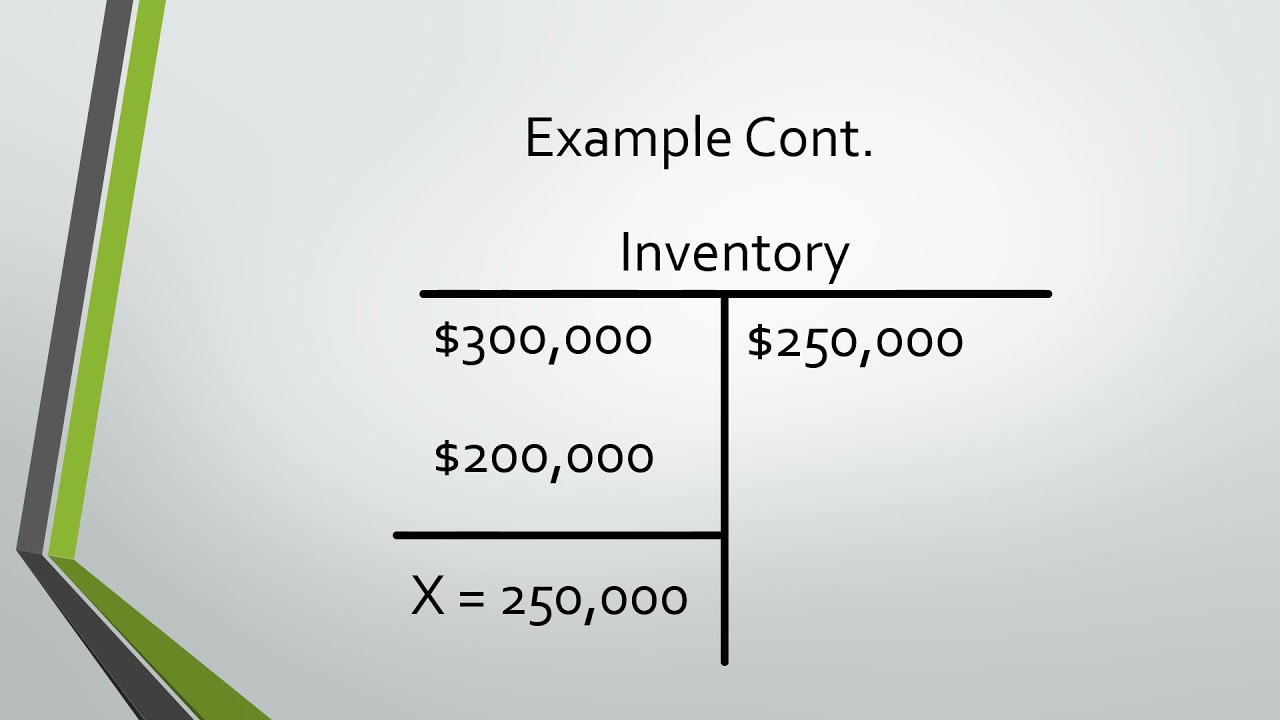

Accounting for inventory offsets involves specific entries and adjustments to reflect the impact of offsets on financial statements. These entries and their effects are crucial for accurate financial reporting.

Recording Inventory Offsets

- Initial Recognition:When an offset is identified, an entry is made to reduce the inventory account and recognize a contra-asset account, such as “Inventory Offset” or “Purchase Returns Allowance.”

- Subsequent Adjustments:As the offset amount changes, adjusting entries are made to update the Inventory Offset account and the related inventory account.

Impact on Financial Statements

- Balance Sheet:The Inventory Offset account is presented as a reduction to the inventory asset on the balance sheet. This results in a lower reported inventory value.

- Income Statement:The adjustment to the Inventory Offset account impacts the cost of goods sold. A decrease in the offset reduces cost of goods sold, while an increase increases cost of goods sold.

Timing of Recognition

Inventory offsets should be recognized when they become known and measurable. This timing ensures accurate financial reporting and prevents overstatement or understatement of inventory.

Advantages and Disadvantages of Inventory Offsets

Inventory offsets can provide several benefits, including:

Reduced Inventory Carrying Costs, Business inventory offset account

Inventory carrying costs encompass expenses associated with storing, handling, and insuring inventory. Offsetting obsolete or slow-moving inventory against more desirable items can help businesses reduce these costs by minimizing the amount of unsold inventory they hold.

Improved Cash Flow

Selling off excess or obsolete inventory can generate cash that can be used to fund other business operations, such as purchasing new inventory or expanding operations. This can improve overall cash flow and financial flexibility.However, there are also potential drawbacks to using inventory offsets:

Increased Risk of Inventory Obsolescence

Offsetting inventory may lead to an accumulation of slow-moving or obsolete items, which can become difficult to sell. This can result in losses due to unsold inventory and reduced profitability.

Potential Tax Implications

In some jurisdictions, offsetting inventory may have tax implications. Businesses should consult with a tax professional to understand the specific tax rules and regulations applicable to their situation.

Practical Applications and Examples: Business Inventory Offset Account

Inventory offsets have been successfully implemented by businesses across various industries. Let’s explore some real-world examples and the lessons learned from these case studies.

Retail Industry

In the retail sector, inventory offsets are commonly used to manage excess inventory and reduce losses. For instance, Macy’s implemented an inventory offset program that allowed them to offset unsold merchandise from their stores against inventory held by their suppliers.

This strategy helped Macy’s reduce its inventory levels and improve cash flow.

Manufacturing Industry

Manufacturers also utilize inventory offsets to optimize their production and inventory management. Toyota, known for its Just-in-Time (JIT) manufacturing system, uses inventory offsets to reduce waste and improve efficiency. By coordinating inventory levels with suppliers, Toyota ensures that materials arrive only when needed for production, minimizing inventory holding costs.

Healthcare Industry

In the healthcare industry, inventory offsets are used to manage medical supplies and pharmaceuticals. Hospitals and clinics often offset surplus inventory with other healthcare providers to reduce waste and ensure efficient utilization of resources. For example, the Mayo Clinic implemented an inventory offset program that allowed them to share excess medical supplies with other hospitals in their network, reducing costs and improving patient care.

Ending Remarks

In conclusion, the business inventory offset account is a valuable tool for businesses seeking to refine their inventory management practices. By leveraging its capabilities, organizations can gain greater control over their inventory levels, enhance their financial reporting accuracy, and ultimately drive profitability.

Key Questions Answered

What is the purpose of a business inventory offset account?

The business inventory offset account is utilized to record the difference between the carrying value of inventory and its estimated net realizable value.

How does a business inventory offset account differ from a traditional inventory account?

Unlike traditional inventory accounts, the business inventory offset account reflects the estimated reduction in the value of inventory due to factors such as obsolescence or damage.

What are the advantages of using a business inventory offset account?

Benefits include reduced inventory carrying costs, improved cash flow, and more accurate financial reporting.