Business inventory mom is a comprehensive guide that provides mom-owned businesses with the tools and strategies they need to effectively manage their inventory. In this guide, we’ll discuss the unique challenges faced by mom-owned businesses in managing inventory, provide strategies for optimizing inventory levels and reducing waste, and explain the importance of inventory tracking and forecasting for small businesses.

We’ll also describe the various inventory financing options available to mom-owned businesses, explain the pros and cons of each financing option, and provide guidance on choosing the right inventory financing option for a specific business.

Inventory Management for Mom-Owned Businesses

Inventory management is a critical aspect of running a successful mom-owned business. However, mom-owned businesses often face unique challenges in managing inventory due to factors such as limited resources, fluctuating demand, and the need to balance work and family life.

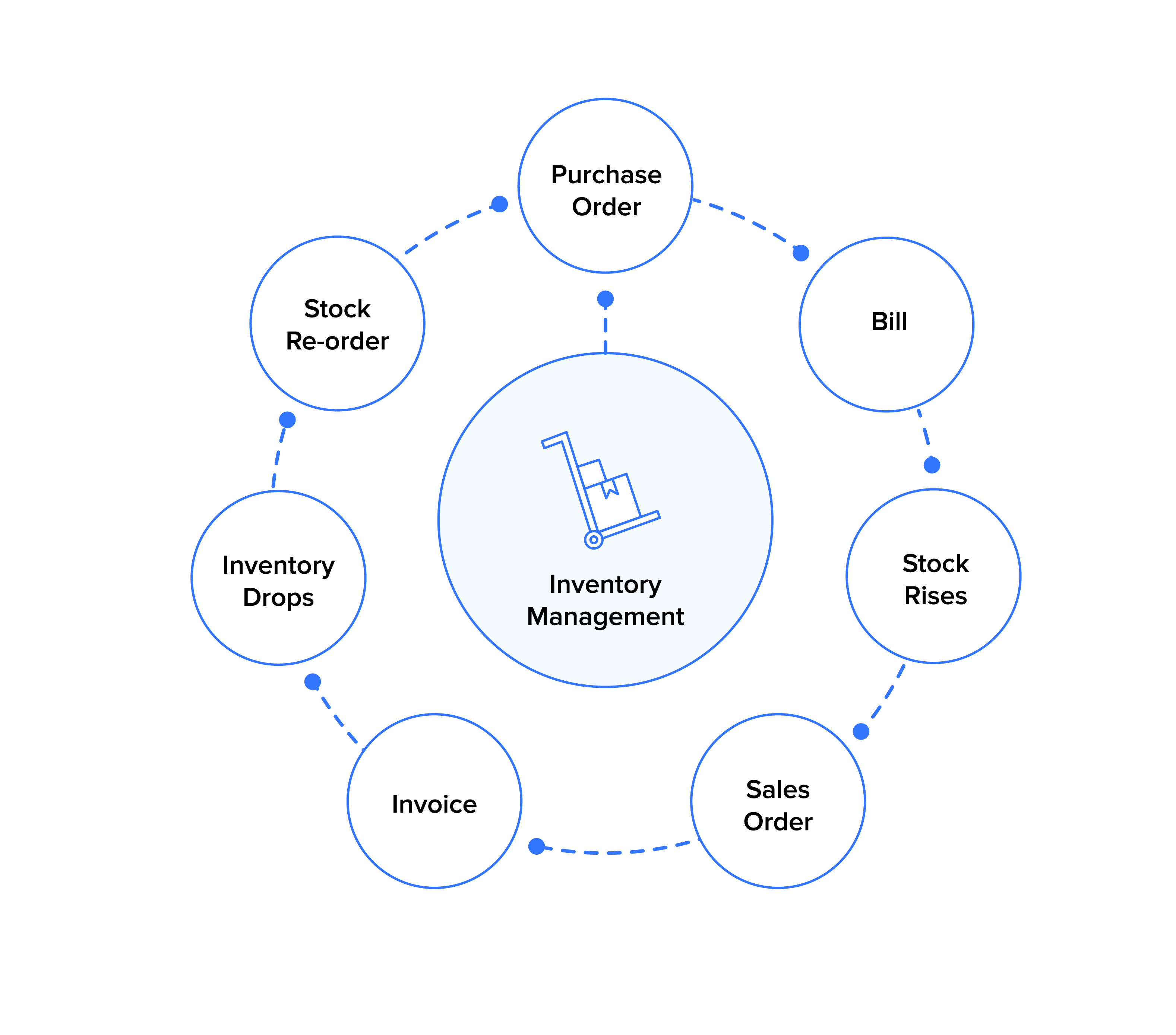

Effective inventory management strategies can help mom-owned businesses optimize inventory levels, reduce waste, and improve profitability. These strategies include:

Inventory Tracking and Forecasting, Business inventory mom

Inventory tracking involves keeping accurate records of inventory levels, including stock on hand, stock in transit, and stock on order. Inventory forecasting helps businesses predict future demand based on historical data and market trends.

Inventory tracking and forecasting are essential for small businesses because they allow businesses to:

- Avoid overstocking and understocking

- Identify slow-moving and fast-moving items

- Plan for seasonal fluctuations in demand

- Improve customer service by ensuring that products are available when customers need them

Inventory Financing Options for Mom-Owned Businesses

Inventory financing is crucial for mom-owned businesses to manage their cash flow and expand their operations. There are various options available, each with its own advantages and disadvantages.

Types of Inventory Financing Options

- Line of Credit:A flexible loan that allows businesses to borrow up to a predetermined amount, repay it, and borrow again as needed.

- Term Loan:A traditional loan with a fixed repayment period and interest rate.

- Invoice Factoring:Selling unpaid invoices to a third party to receive immediate cash.

- Inventory Loan:A loan secured by the business’s inventory, often at lower interest rates.

- Crowdfunding:Raising funds from a large number of investors through online platforms.

Pros and Cons of Inventory Financing Options

Line of Credit:

Pros

Flexibility, quick access to funds

Cons

Fluctuating interest rates, potential fees Term Loan:

Pros

Fixed interest rates, predictable payments

Cons

Limited flexibility, may require collateral Invoice Factoring:

Pros

Immediate cash flow, reduced risk of bad debts

Cons

Can be expensive, loss of control over accounts receivable Inventory Loan:

Pros

Lower interest rates, secured by inventory

Cons

Can be risky if inventory value fluctuates Crowdfunding:

Pros

Can raise large amounts of capital, build community

Cons

Can be time-consuming, potential for dilution of ownership

Choosing the Right Inventory Financing Option

The best inventory financing option depends on the specific needs and circumstances of the business. Consider the following factors:

- Cash flow requirements

- Repayment capacity

- Risk tolerance

- Availability of collateral

- Cost of financing

By carefully evaluating these options and seeking professional advice if needed, mom-owned businesses can find the inventory financing solution that supports their growth and profitability.

Inventory Management Best Practices for Mom-Owned Businesses

Effective inventory management is crucial for mom-owned businesses to optimize operations, reduce costs, and enhance customer satisfaction. Implementing best practices ensures accurate inventory tracking, efficient stock management, and improved decision-making.

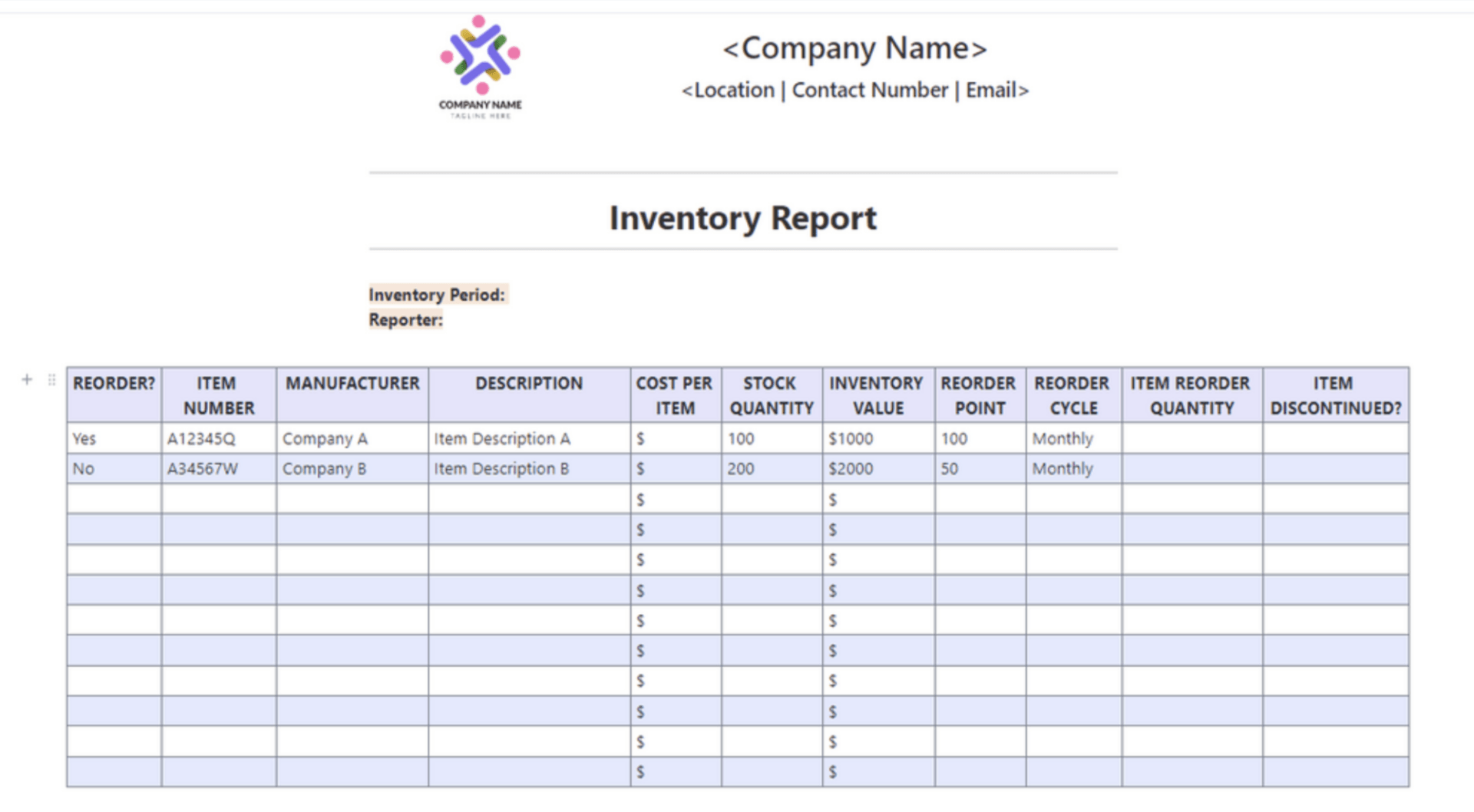

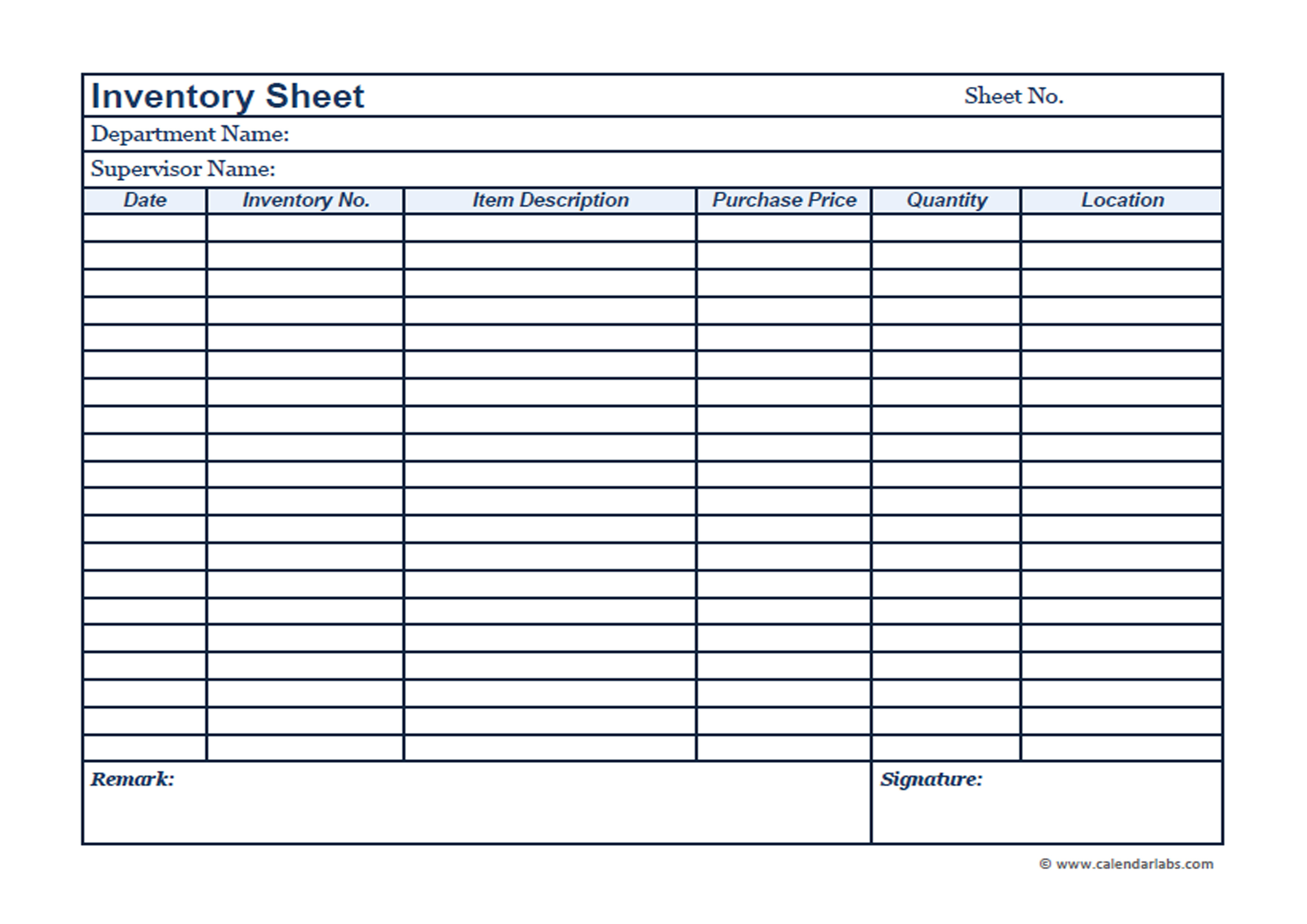

One key practice is inventory categorization. Classifying inventory based on factors like product type, demand, and value helps businesses prioritize stock levels and allocate resources effectively. Cycle counting involves regularly checking inventory levels at specific intervals to identify discrepancies and ensure accuracy.

Inventory Audits

Periodic inventory audits provide a comprehensive assessment of inventory accuracy and identify potential issues. They involve physically counting all inventory items and reconciling them with records. This process helps detect shrinkage, theft, or errors and ensures that inventory data is reliable.

Inventory Management Software

Utilizing inventory management software streamlines inventory tracking and automates tasks. These systems provide real-time visibility into inventory levels, facilitate order fulfillment, and generate reports for analysis. By leveraging technology, businesses can improve efficiency, reduce errors, and make informed decisions.

Improving Inventory Accuracy and Efficiency

To enhance inventory accuracy, businesses should implement barcode scanning, use automated inventory systems, and conduct regular inventory reconciliations. Additionally, training staff on proper inventory handling procedures and establishing clear inventory policies can minimize errors.

Case Studies of Successful Inventory Management in Mom-Owned Businesses: Business Inventory Mom

Mom-owned businesses face unique challenges in inventory management due to limited resources, time constraints, and the need to balance family and work life. However, many mom-owned businesses have successfully implemented effective inventory management strategies to overcome these challenges and achieve business success.

These case studies showcase the challenges faced by mom-owned businesses and the solutions they implemented to improve inventory management, resulting in increased sales, reduced costs, and improved customer satisfaction.

Online Boutique

An online boutique owner faced challenges with overstocking and slow-moving inventory. She implemented a demand forecasting tool that analyzed sales data and customer behavior to predict future demand. This helped her optimize inventory levels, reduce overstocking, and increase sales by 15%.

Handmade Crafts Business

A mom-owned handmade crafts business struggled with managing inventory across multiple sales channels. She implemented an inventory management system that integrated with her online store, Etsy shop, and social media platforms. This streamlined inventory tracking, reduced errors, and improved customer satisfaction by providing accurate product availability information.

Home-Based Bakery

A home-based bakery owner faced challenges with perishable inventory and limited storage space. She implemented a first-in, first-out (FIFO) inventory system to ensure that older inventory was sold first. She also partnered with a local food bank to donate excess inventory, reducing waste and improving community relations.

Conclusion

By following the strategies and advice Artikeld in this guide, mom-owned businesses can improve their inventory management practices, reduce costs, increase sales, and improve customer satisfaction.

FAQ Resource

What are the unique challenges faced by mom-owned businesses in managing inventory?

Mom-owned businesses often face unique challenges in managing inventory, such as limited time and resources, lack of experience, and difficulty in obtaining financing.

What are some strategies for optimizing inventory levels and reducing waste?

There are a number of strategies that mom-owned businesses can use to optimize inventory levels and reduce waste, such as using inventory management software, implementing cycle counting, and conducting regular inventory audits.

What are the importance of inventory tracking and forecasting for small businesses?

Inventory tracking and forecasting are essential for small businesses, as they allow businesses to keep track of their inventory levels, identify trends, and make informed decisions about ordering and stocking inventory.